Estate Planning

Carrying out your wishes. Protecting your legacy.

Estate Planning Advice

The right estate plan can make all the difference — protecting your family and assets, taking away unnecessary stresses and financial hardships, and ultimately ensuring you’re able to support future generations.

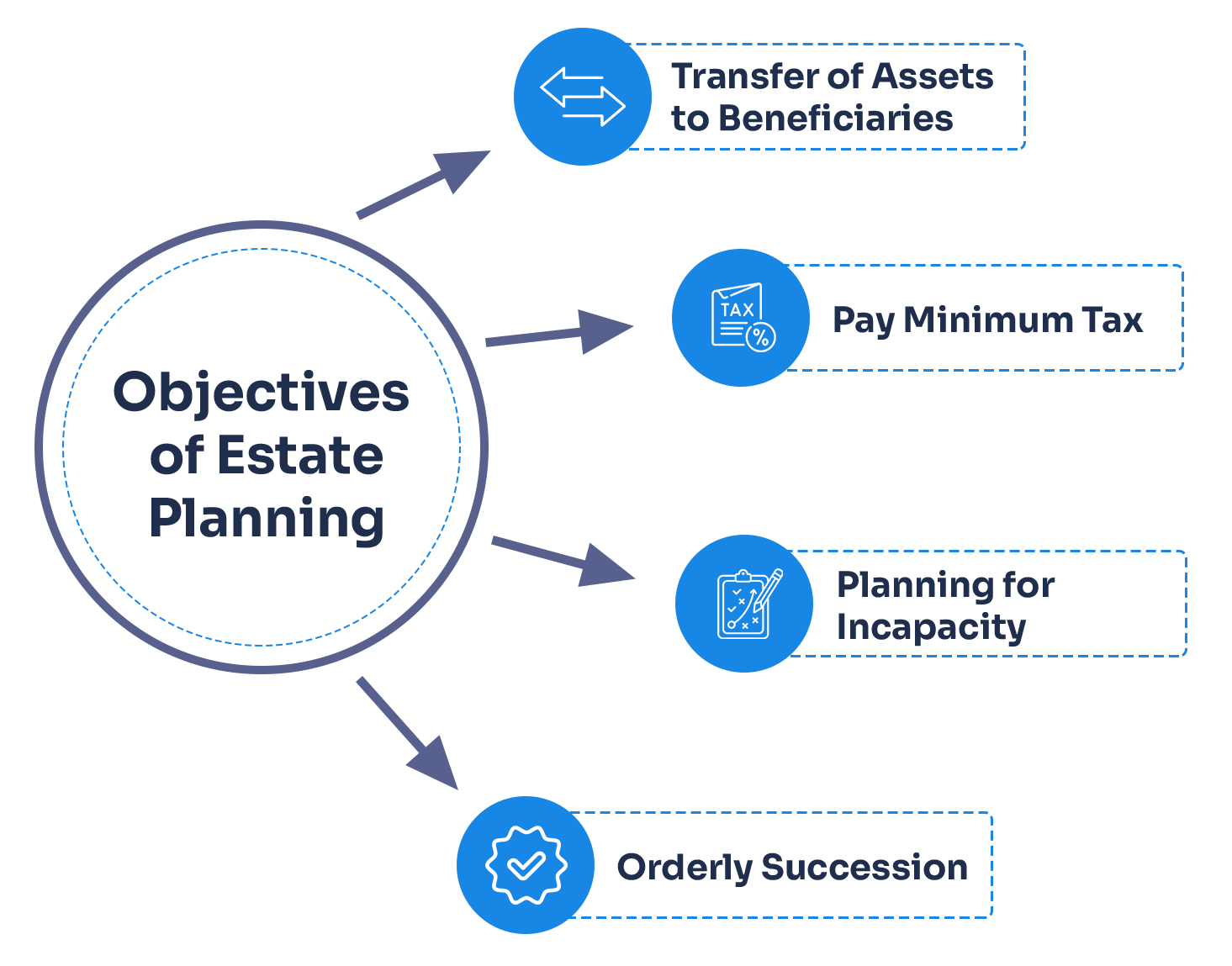

Estate Planning is all about placing the right funds in the right hands at the right time. This may be during your lifetime or through your will. The right plan can ensure that your assets are passed on according to your wishes.

Capital Wealth Advice will give you comprehensive estate planning advice to ensure your estate is protected and distributed according to your wishes in a tax effective manner.

We can assist with:

- Binding and non binding death benefit nominations.

- Inter-generational wealth transfer.

- Structuring your transfer of assets tax effectively.

Contact Paul for an obligation free discussion.